$750k-$5m Seed / Series checks into the next generation of AI + B2B

Key Exits + Investments

FAQ / $200m SaaStr Fund

SaaStr Fund invests in 4-5 awesome B2B start-ups a year, generally in the $0.1m to $2m ARR range.

We are focused on AI-driven next-generation B2B leaders.

$100k - $2m in ARR is our sweet spot. Before $10k MRR is usually a bit too early for us, and after $2m ARR or so is usually a bit late. Most Series A rounds are a bit too late for us, unless you’ve been capital efficient.

We write first checks from $500k-$5000k. Tiny checks are tough to do. Checks larger than $5m generally require a co-investor of some form, but we can lead it. We prefer to lead than follow. Round sizes larger than $10m are tough for us to participate in.

We prefer / are OK being the only investor in the round or even the company and do not require any social proof or any co-investors whatsoever. We are also thrilled to be your first investor ever. We make fewer, bigger, better bets.

We don’t do small checks. We prefer to lead or co-lead seed and late seed rounds, 2-4 a year ideally. We don’t write $50k-$250k checks and we’re not looking for a high volume of investments. Rather, we aim for a very high success rate of a smaller number of concentrated investments.

We prefer Outsiders + Outliers. Folks that didn’t go to Those Schools, or Work at That Hot Tech Company. The ones that did it on their own, that earned it, and got to 10+ Unaffiliated Customers on their own.

We prefer founders from more diverse backgrounds. We’ve invested in founders from 12+ countries and prefer founding teams with significant gender and cultural diversity. We believe this builds stronger unicorns.

We are pretty good investors. Our investments are at 10x+ over history, and 5/6 of our first seed investments become unicorns and decacorns . 🦄🦄🦄🦄🦄. So we don’t sweat the small stuff. And we want you to go big, the way you think is right.

We aren’t a great fit if you’ve already raised a ton of money. It’s hard for us to invest if you’ve already raised much more than $3m-$4m. Not impossible, but harder.

We want the founder/CEO to be the CEO forever. We want to invest in founder-CEOs than want to run their companies forever. 50% of our bet is there.

We only do B2B/B2D/AI. I.e., only business software, AI, APIs and tools that enable the building of software. We don’t invest in consumer start-ups, or subscription services that have elements of recurring revenue but are not primarily software products.

Pre-revenue is too early. We can only invest if you have at least 10 Unaffiliated Customers, and ideally, $10k+ or more in MRR.

We are happy to invest with startups based anywhere in the world (everything has flattened), but prefer folks that come to Bay Area at least a few times a year. It does make it easier to meet, recruit, fundraise, partner, etc. Even now.

It’s your company.

When we invest, it’s up to you. We hope you IPO and build a decacorn. But wherever it takes us, as long as you do your best-est, we are there for you.

How we add value:

Find, attract and help build your first management team, especially VP of Sales and Marketing

Promote your company across the SaaStr ecosystem (1m+ followers, #1 in B2B, mega-events for 50,000+)

Find your next round investor for you (assuming you deliver the results). If you hit your numbers, we will get you funded.

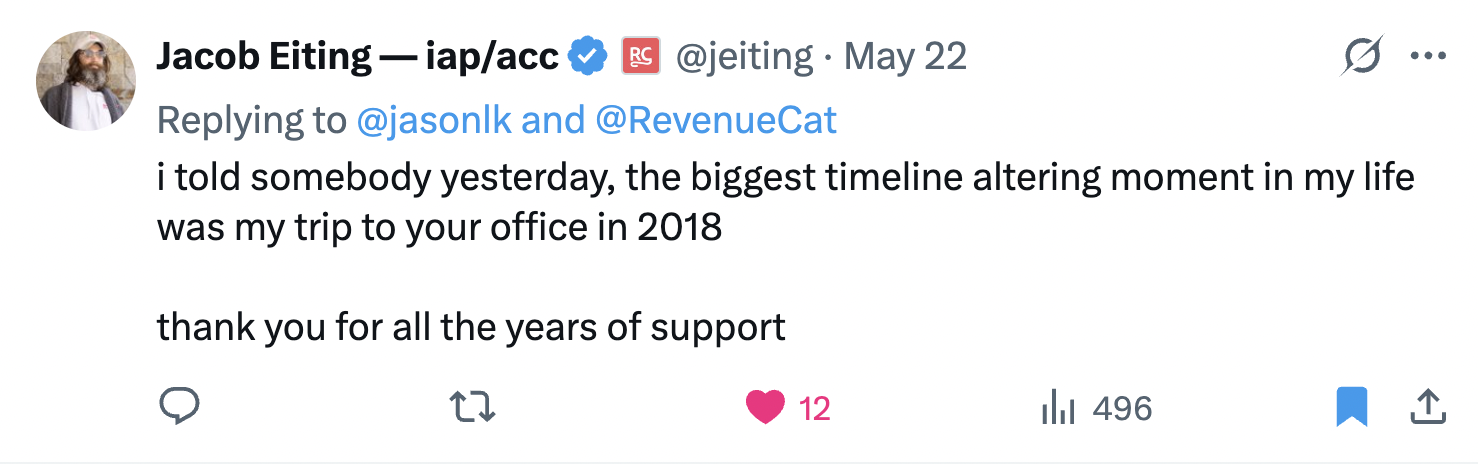

Be your mentor and advisor forever. This is half the fun. Then, the day comes when you know more about B2B that we do, and that’s a good day.

Be someone you can trust. Sometimes, that may mean the only one to share the truth. But always honestly, and to help you do great things.